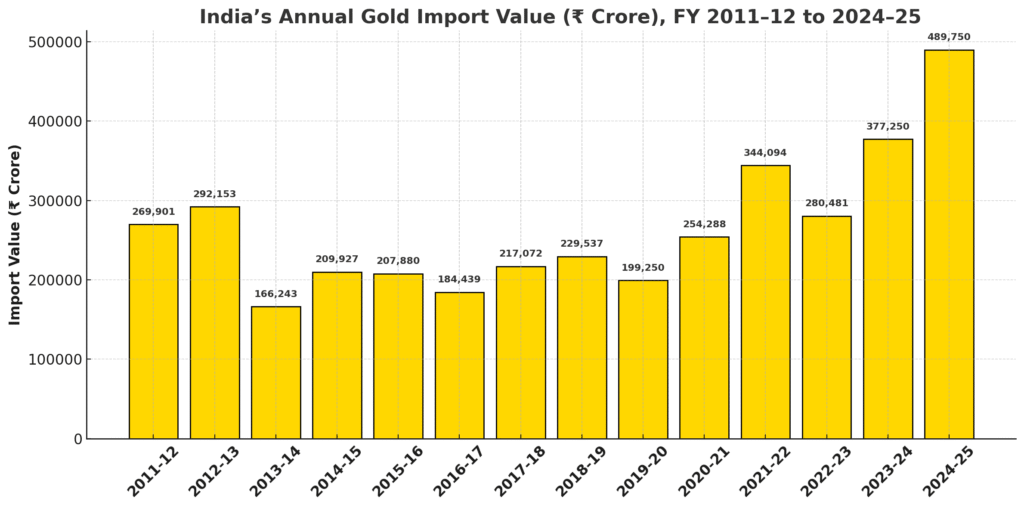

India’s Gold Obsession by the Numbers: 14 Years, ₹37 Lakh Crore, and a Swiss Surprise

India’s love affair with gold isn’t just cultural—it’s financial. Over the last 14 financial years, the country has imported a staggering ₹37,08,920 crore worth of gold. That’s more than India’s total annual budget in 2024! Let us dive into a year-by-year breakdown of India’s gold imports, where it comes from, and what the numbers reveal about this glittering obsession.

How Much Gold Does India Import?

Here’s the total import value of gold in ₹ crore over the last 14 years:

| Financial Year | Import Value (₹ Crore) |

| 2011-12 | 2,69,901 |

| 2012-13 | 2,92,153 |

| 2013-14 | 1,66,243 |

| 2014-15 | 2,09,927 |

| 2015-16 | 2,07,880 |

| 2016-17 | 1,84,439 |

| 2017-18 | 2,17,072 |

| 2018-19 | 2,29,537 |

| 2019-20 | 1,99,250 |

| 2020-21 | 2,54,288 |

| 2021-22 | 3,44,094 |

| 2022-23 | 2,80,481 |

| 2023-24 | 3,77,250 |

| 2024-25 (Provisional) | 4,89,750 |

Total Gold Import Value (2011–2025) = ₹37,08,920 crore

Let’s take a visual look at how India’s gold import bill has grown over the years:

Where Does All This Gold Come From?

The surprise? Switzerland.

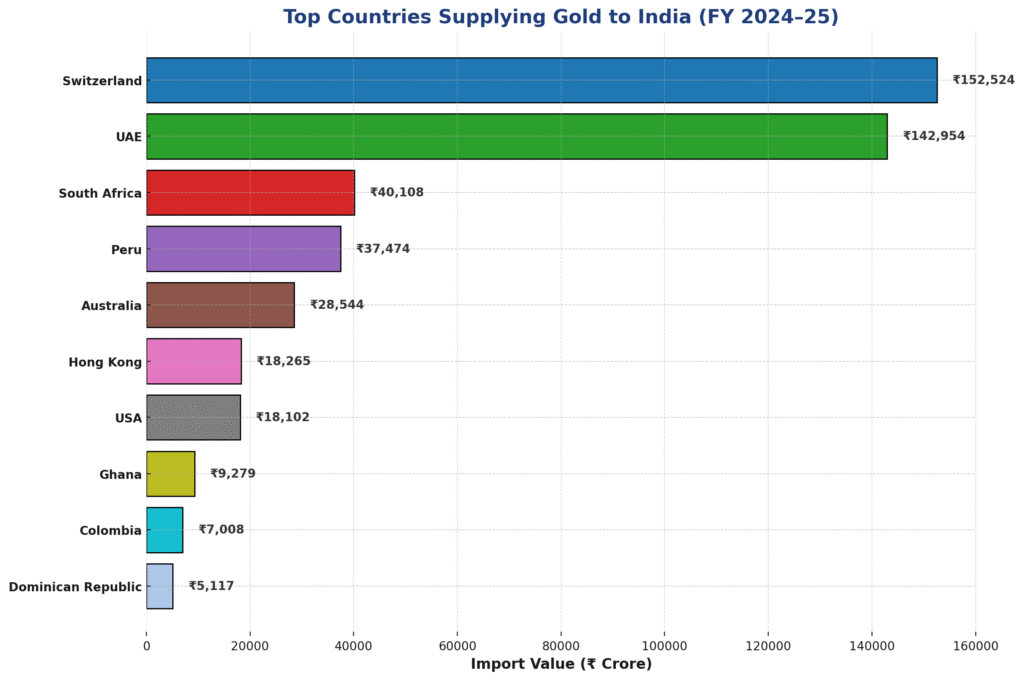

In FY 2024–25, India’s largest source of gold imports was Switzerland, followed closely by the UAE and South Africa. Here’s a look at the top 10 source countries by value:

| Country | Import Value (₹ Crore) |

| Switzerland | 1,52,524 |

| UAE | 1,42,954 |

| South Africa | 40,108 |

| Peru | 37,474 |

| Australia | 28,544 |

| Hong Kong | 18,265 |

| USA | 18,102 |

| Ghana | 9,279 |

| Colombia | 7,008 |

| Dominican Republic | 5,117 |

Despite being a small country, Switzerland has long served as a global gold refining hub, which explains its dominance in India’s gold import ledger.

To complement the table, the following chart offers a visual breakdown of India’s gold imports by country for FY 2024–25.

What Do These Numbers Tell Us?

- Steady Demand, Big Money: Even in years of economic uncertainty, gold imports rarely dipped below ₹2 lakh crore. India’s appetite is unwavering.

- Post-COVID Surge: After the pandemic, gold imports rebounded sharply. FY 2021–22 saw a sharp spike, confirming gold’s role as a safe-haven asset. (See also: Gold Price History in India)

- Record-Breaking 2024–25: At ₹4.89 lakh crore, this year’s provisional import value is the highest ever, hinting at record volumes, soaring prices.

- Switzerland’s Dominance: As explained in our earlier blog, Why India Was Called the Golden Bird, India’s wealth—and imports—have long been tied to gold. Switzerland’s refining ability keeps it at the top.

- An 80:20 Insight: Nearly 80% of gold import value since 2011 has come from just six countries—Switzerland, UAE, South Africa, Peru, Australia, and Hong Kong. A clear case of concentrated global trade dependencies.

- Gold vs Other Assets: ₹37 lakh crore in 14 years is a testament to gold’s dominance in Indian investment psyche.

- Cultural Pull, Economic Weight: Be it weddings, festivals, or savings, India’s relationship with gold is emotional and economic—an obsession that fuels multi-trillion-rupee trade.

Methodology & Sources (Year-wise)

| Financial Year | Source |

| 2011-12 to 2013-14 | Press Information Bureau |

| 2014-15 | Financial Express |

| 2015-16 | Data.gov.in |

| 2016-17 to 2024-25 | Department of Commerce Dashboard |

For FY 2014–15 and 2015–16: Import values were originally in USD and converted using average annual exchange rates of ₹61.15/USD (2014–15) and ₹65.46/USD (2015–16), based on RBI data.

Our Data Promise

All figures are based on official Indian government sources. Exchange rates are standardized to ₹ crore, and tonnage is avoided for consistency and clarity.

Ready for a Quick Quiz?

Results

#1. Which country was the top supplier of gold to India in FY 2024–25?

#2. Approximately 80% of India’s gold imports in the last 14 years came from how many countries?

Want more stories like this? Explore more data-driven insights at Indiagraphs.com

About Indiagraphs Insights

Indiagraphs is a data storytelling platform focused on decoding India’s economy, policy, and people — one graph at a time.