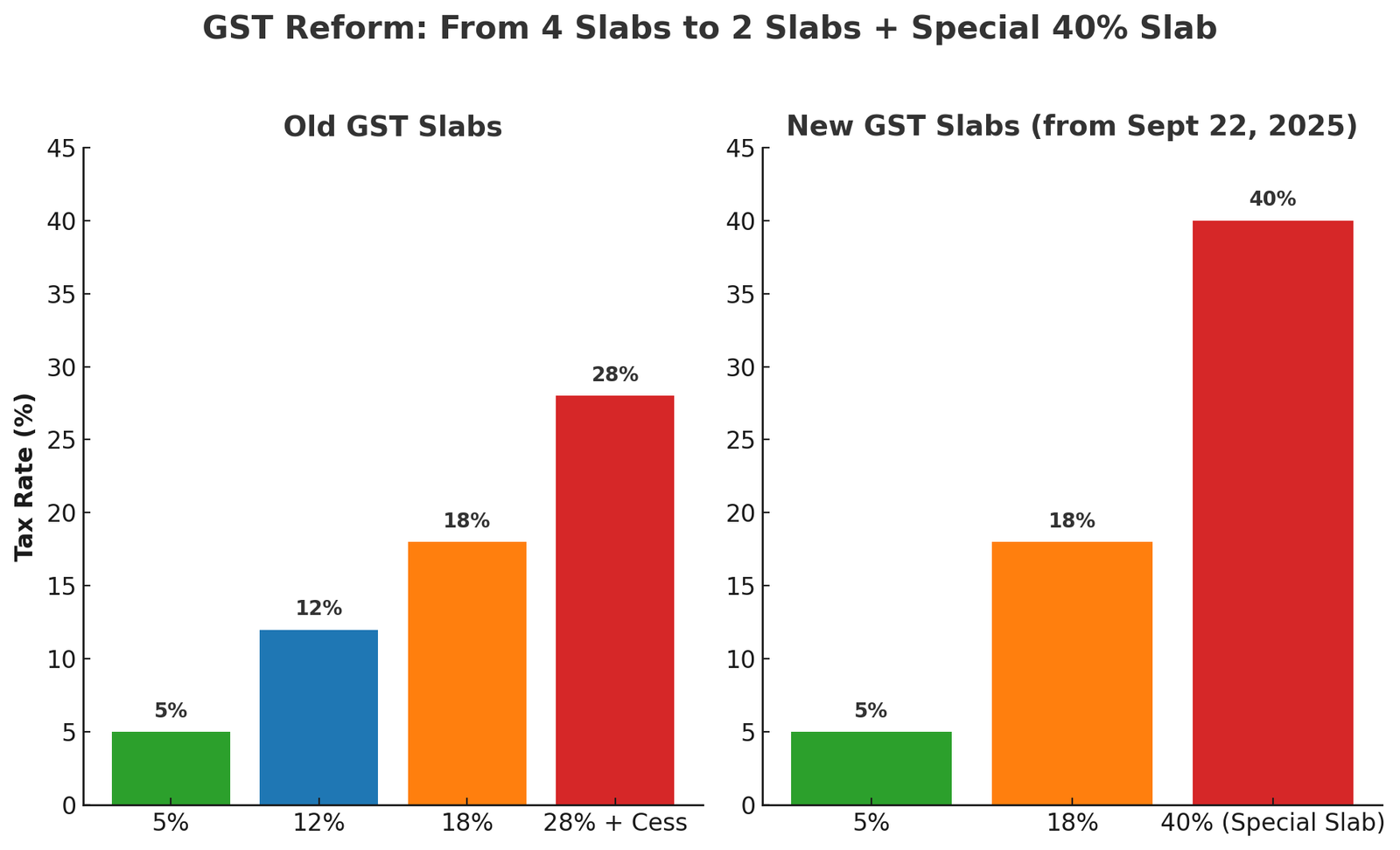

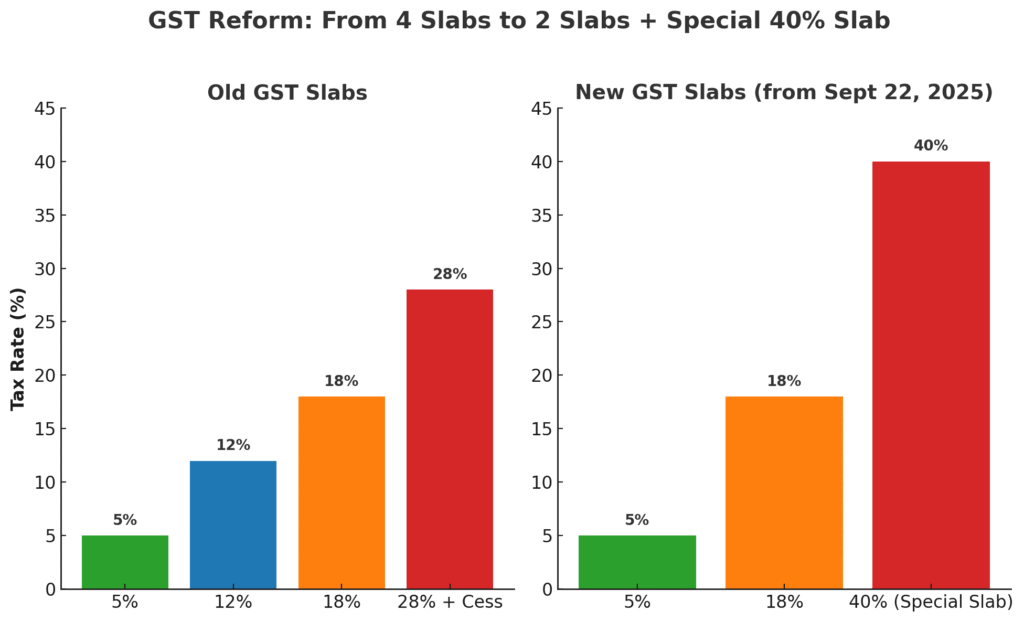

GST Reform 2025: India Moves to Two Slabs (5% & 18%) + Special 40% Slab from Sept 22

India’s indirect tax system is finally simpler.

After years of juggling between 5%, 12%, 18%, and 28%, the GST Council has collapsed the structure into just two standard slabs:

- 5% → For essentials and daily-use goods

- 18% → For most other goods & services

And alongside these, there’s a Special 40% Slab — only for specific products like tobacco, pan masala, gutkha, cigarettes, and carbonated drinks, where taxes are meant to discourage harmful consumption.

From 22 September 2025, India will move to a two-slab GST structure.

What It Means for You

| New GST Structure | Rate | Examples |

|---|---|---|

| Lower Slab | 5% (or NIL on select items) | Daily essentials, medicines, food items, books, handicrafts, basic household goods |

| Standard Slab | 18% | Most goods & services – electronics, appliances, small cars, cement, furniture, transport, healthcare services |

| Special Slab | 40% (Retail Price based) | Tobacco, pan masala, gutkha, cigarettes, carbonated drinks, luxury vehicles |

Why This Matters

- Simpler than before: No more juggling between 5%, 12%, 18%, 28% — just two clear rates for 95% of items.

- Cheaper essentials: Milk products, medicines, snacks, school items → lower taxes = lighter bills.

- Middle-class relief: White goods like TVs, ACs, cement, and small vehicles drop to 18% slab, down from 28%.

- Health push: Tobacco & pan masala won’t enjoy loopholes — now taxed at a steep 40% on MRP.

Timeline

- 22 Sept 2025 – New GST rates go live.

- Later – Tobacco & pan masala will shift to the 40% RSP system only after pending GST compensation cess loans (taken during COVID to pay states) are fully repaid. Until then, they remain under the old GST + cess regime.

Why Tobacco & Pan Masala Tax Is Delayed

When GST launched in 2017, a compensation cess was imposed on items like coal, luxury cars, and tobacco to fund state revenues.

During COVID, the Centre borrowed extra money to pay states – those loans and their interest are still being repaid.

That’s why these products will stay under the cess regime for now. Once dues are cleared, the Finance Minister will announce the switch to the new 40% system.

Indiagraphs Take

This reform is not just tax arithmetic — it’s about trust and clarity.

- For the consumer – fewer slabs, fewer surprises at checkout.

- For the economy – cheaper essentials and mid-range goods may boost demand.

- For the government – a bold move balancing revenue needs with relief for households.

India now moves closer to global standards with a simpler, people-friendly GST system.

Here is an Indiagraphs GST Calculator to quickly compute your tax amount with ease.

Source: PIB, Ministry of Finance