India’s April–September 2025 exports hit US$413.3 bn, up 4.45% – non-petroleum gains lead recovery

New Delhi, 15 Oct 2025 – As per the Department of Commerce (PIB release), cumulative exports (merchandise + services) for April–September 2025 rose to US$ 413.30 billion, a 4.45% increase over April–September 2024, signalling firm non-petroleum export momentum.

Key Highlights

- Total exports Apr–Sep 2025: US$ 413.30 bn vs US$ 395.71 bn a year earlier – +4.45%. Total imports: US$ 472.79 bn (+3.55%). (Dept. of Commerce / PIB, 15 Oct 2025).

- Merchandise exports Apr–Sep: US$ 220.12 bn (+3.02%). Non-petroleum exports: US$ 189.49 bn – +7.04%, showing diversification beyond oil & gems.

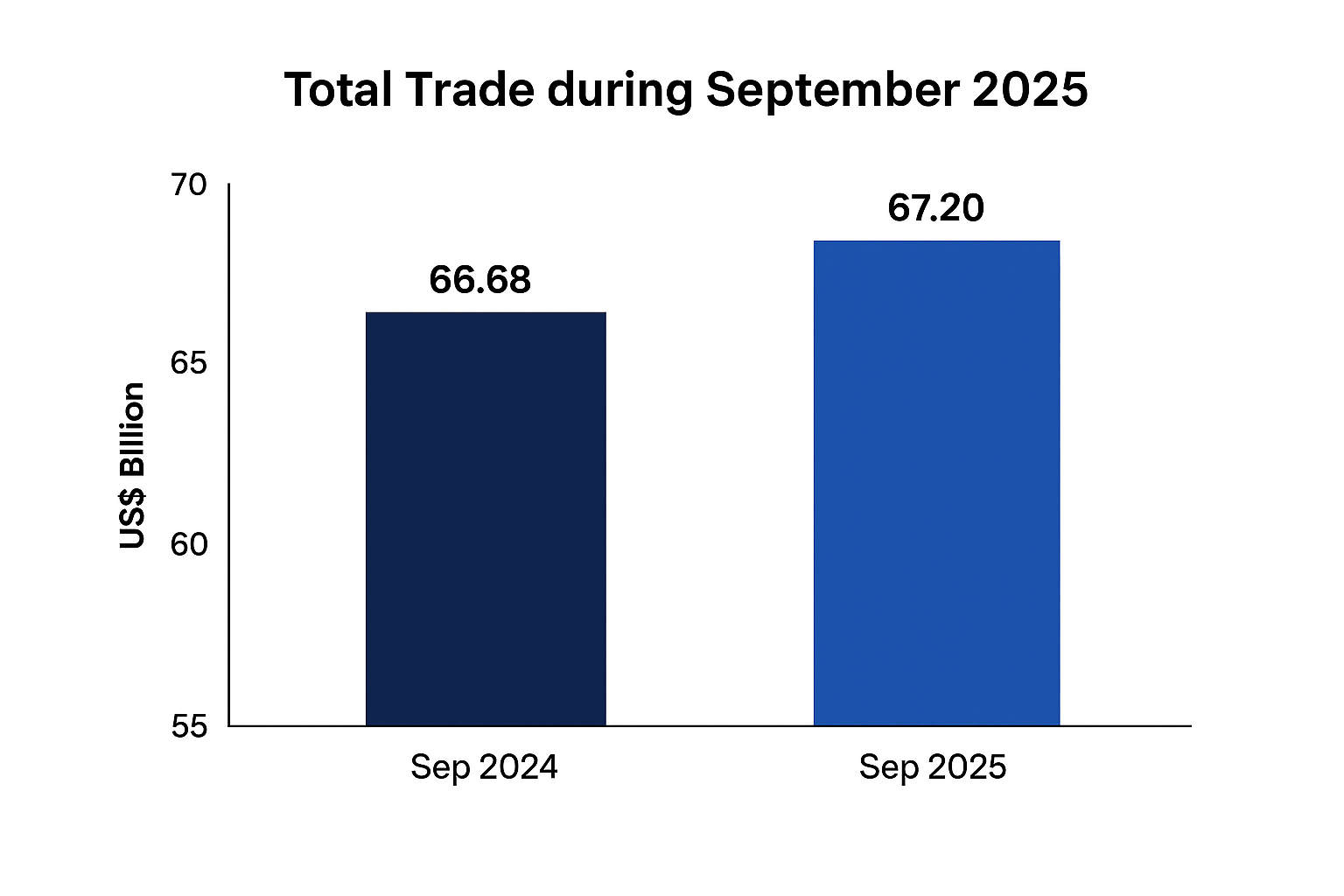

- September 2025 month: Exports US$ 67.20 bn (+0.78% y/y); Imports US$ 83.82 bn (+11.34% y/y); trade balance for Sep: -16.61 bn. Services exports Apr–Sep: US$ 193.18 bn, raising the services surplus to US$ 95.50 bn.

- Top merchandise movers in September: Electronic Goods (+50.54%), Rice (+33.18%), Marine Products (+23.44%), Petroleum Products (+15.22%), and Engineering Goods (+2.93%) – Electronic Goods jumped from US$ 2.07 bn to US$ 3.12 bn in Sep.

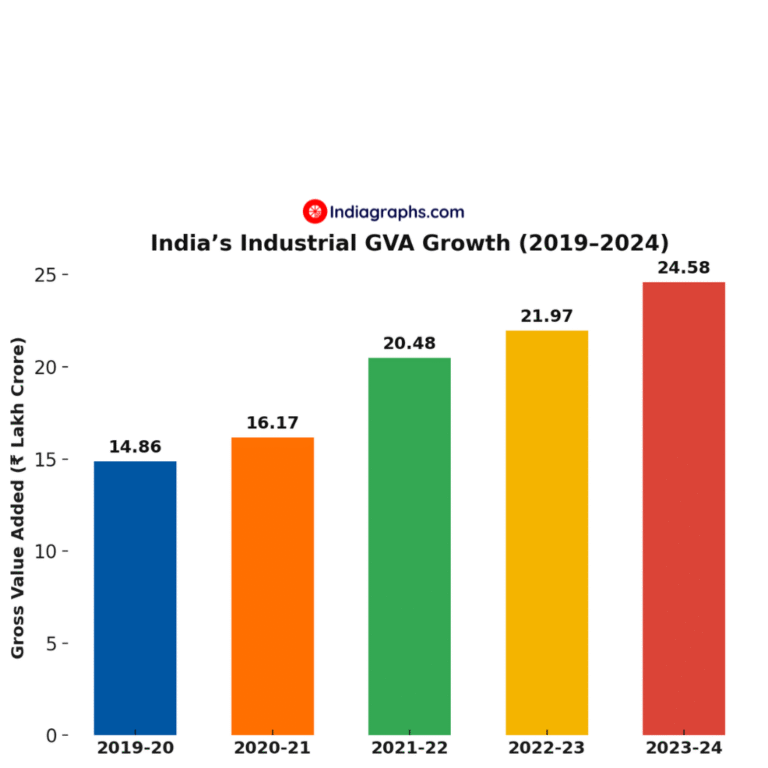

- External context: IMF upgraded India’s 2025 GDP forecast to 6.6% (Oct 2025 WEO update); Department of Commerce notes this supports export momentum.

India’s Trade Snapshot (April–September 2025 vs 2024)

| Category | Apr–Sep 2025 (US$ Billion) | Apr–Sep 2024 (US$ Billion) | % Change YoY |

|---|---|---|---|

| Total Exports (Merchandise + Services) | 413.30 | 395.71 | +4.45 % |

| Total Imports (Merchandise + Services) | 472.79 | 456.58 | +3.55 % |

| Trade Balance | -59.48 | -60.87 | — |

| Merchandise Exports | 220.12 | 213.68 | +3.02 % |

| Merchandise Imports | 375.11 | 358.85 | +4.53 % |

| Non-Petroleum Exports | 189.49 | 177.03 | +7.04 % |

| Non-Petroleum Imports | 282.98 | 265.80 | +6.47 % |

| Services Exports | 193.18 | 182.03 | +6.12 % |

| Services Imports | 97.68 | 97.73 | -0.05 % |

| Services Trade Surplus | 95.50 | 84.31 | +13.27 % |

India’s April–September 2025 trade picture shows cautious improvement – a modest rise in total exports (4.45%) backed by strong non-petroleum and services performance, even as import growth widens the deficit. Continued focus on electronics, engineering and value-added services can help sustain export diversification and cushion external imbalances.