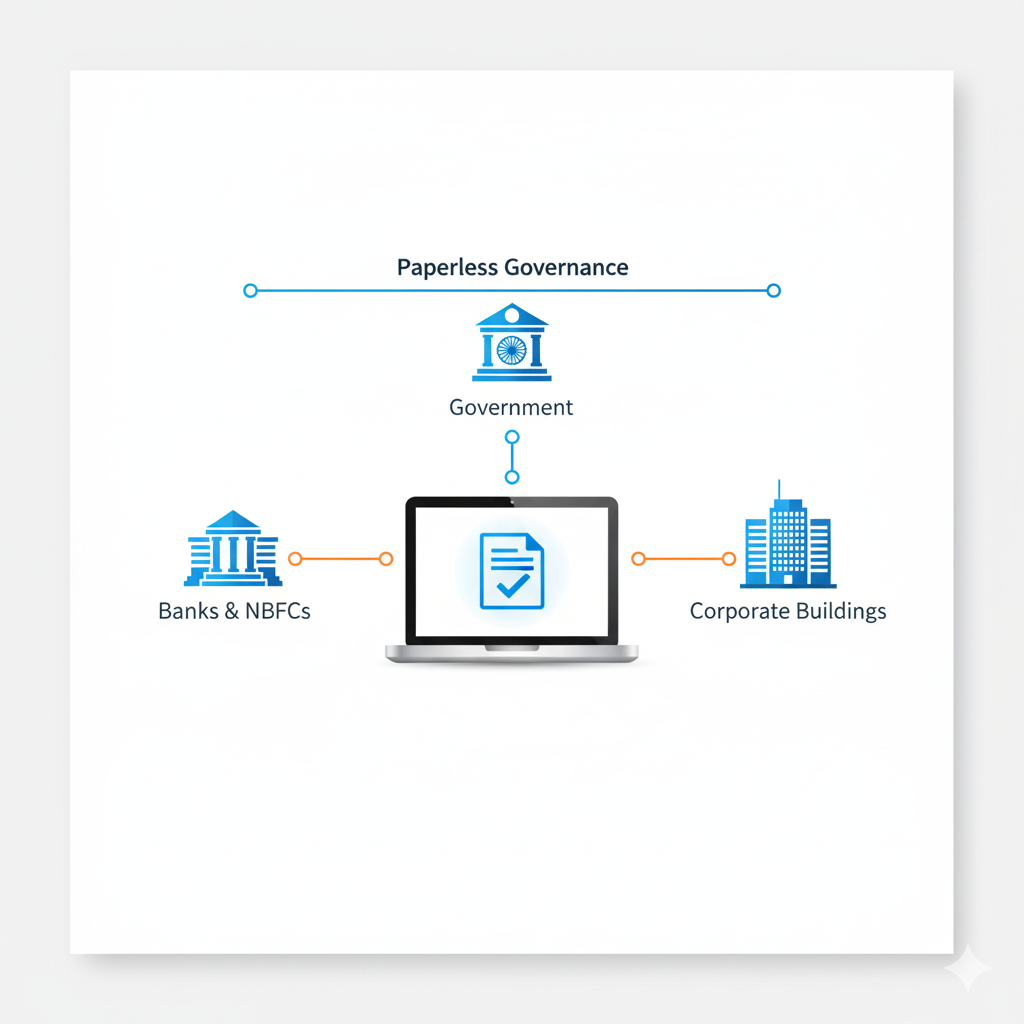

India Moves Closer to Paperless Governance with Real-Time Digital Bank Guarantee Execution

As per PIB’s 8 Oct 2025 release, India has taken another major step toward paperless governance. The National e-Governance Division (NeGD) and National E-Governance Services Ltd (NeSL) have signed an MoU to enable real-time digital document execution for electronic bank guarantees (e-BGs) – cutting processing time from days to just minutes.

Key Highlights

- Over 60 institutions, including banks, NBFCs, and corporates, will now issue, renew, and invoke digital bank guarantees (e-BGs) within minutes, compared to several days earlier.

- The collaboration between National e-Governance Division (NeGD) and National E-Governance Services Limited (NeSL) was formalized through an MoU signed at Global Fintech Fest 2025.

- Integration of Entity Locker (part of DigiLocker) with NeSL’s Digital Document Execution (DDE) platform ensures secure, paperless, and legally enforceable digital contracts.

- Benefits include faster processing, centralized verification, environmental sustainability, and full legal compliance under the Insolvency and Bankruptcy Code, 2016.

- This initiative boosts India’s Ease of Doing Business, promotes data security and privacy, and strengthens the country’s Digital Governance Vision.

Impact of Digital Bank Guarantee (e-BG) Integration

| Parameter | Physical BG (Before) | e-BG (Now) |

|---|---|---|

| Processing Time | 3–5 days | Few minutes |

| Mode | Paper-based | Fully digital |

| Verification | Manual | Central Repository (NeSL) |

| Environmental Impact | High (paper usage) | Eco-friendly |

| Legality | Physical stamp required | Digitally enforceable |

This partnership between NeGD and NeSL signifies India’s decisive move toward a digitally empowered financial system. By reducing bank guarantee processing time from days to minutes, it enhances efficiency, transparency, and sustainability — marking another step in building a paperless and trusted governance ecosystem.

Source : Ministry of Electronics & IT , PIB