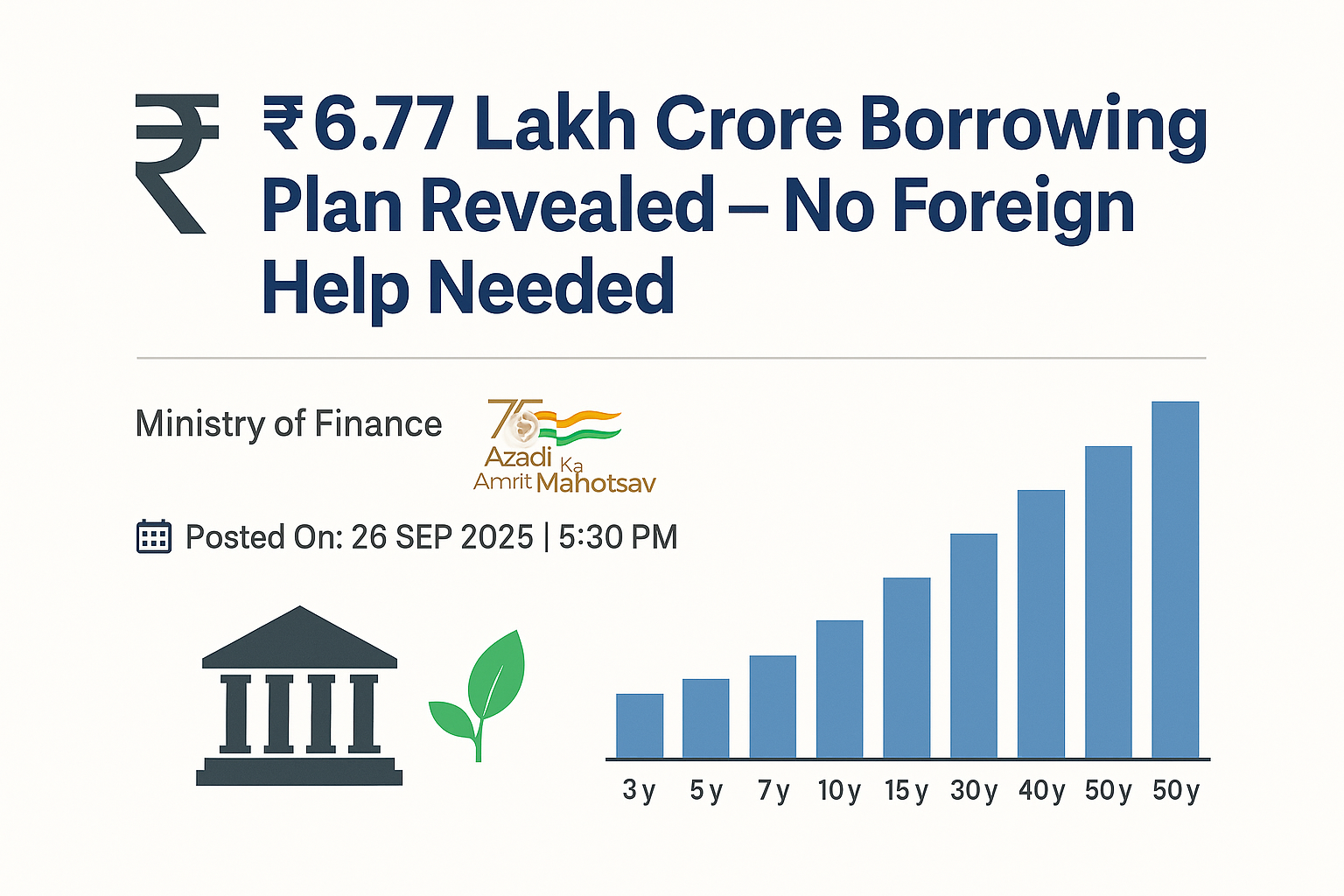

Government Unveils ₹6.77 Lakh Crore Borrowing Plan – What It Means for You

The Government of India, in consultation with the Reserve Bank of India (RBI), has finalized its borrowing programme for the second half (H2) of FY 2025-26.

The Borrowing Plan –

- Total Borrowing: ₹6.77 lakh crore through dated securities.

- Green Push: ₹10,000 crore will come from Sovereign Green Bonds (SGrBs), showing the government’s commitment to climate-friendly investments.

- Timeline: 22 weekly auctions will be conducted till March 6, 2026.

- Maturities: The borrowing is spread across different timelines — from 3 years to as long as 50 years, giving investors choices and ensuring stability.

- 3-year (6.6%)

- 5-year (13.3%)

- 7-year (8.1%)

- 10-year (28.4%)

- 15-year (14.2%)

- 30-year (9.2%)

- 40-year (11.1%)

- 50-year (9.2%)

Treasury Bills – The Short-Term Part

For shorter needs, the government will also issue Treasury Bills in Q3 FY 2025-26 worth ₹19,000 crore every week:

- 91-day: ₹7,000 crore

- 182-day: ₹6,000 crore

- 364-day: ₹6,000 crore

Other Measures for Stability

- Buyback & Switching: To prevent sudden repayment pressure, older bonds will be bought back or swapped.

- Greenshoe Option: Each auction may allow up to ₹2,000 crore of extra borrowing if the demand is strong.

- WMA Limit: RBI has set a ₹50,000 crore limit under Ways and Means Advances to handle temporary mismatches between government receipts and payments.

What Makes This Unique?

In global discussions, questions often arise – Is India borrowing from abroad?

The answer here is clear: No. Every rupee will be raised domestically. This shows the depth of India’s financial markets and reduces reliance on foreign funds.

Source: Ministry of Finance, PIB