Should You Consider Gold in the Long Run? A 42-Year Data Story of Price & CAGR in India

Updated on: 22 October 2025

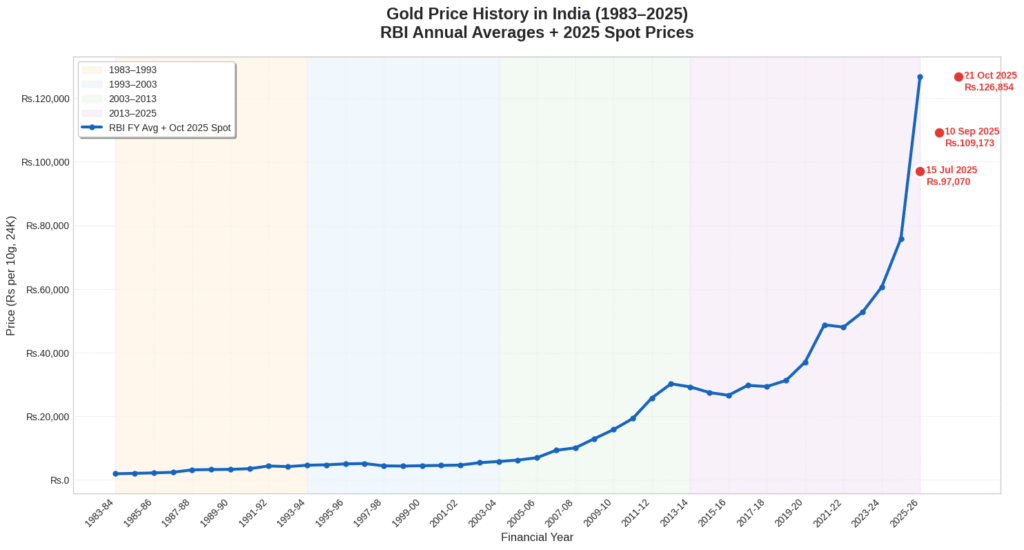

India’s fascination with gold isn’t just cultural – it’s economic. From weddings to investments, gold plays a central role in Indian households. But how much has gold grown in India? In 1983, it was just ₹1,858 per 10g. In 2025, it reached ₹1,26,854 per 10g (as of 21 October 2025). Backed by RBI data, this 42-year journey of gold price history in India reveals gold’s CAGR, growth spikes, and insights for investors.

Note: This post includes the latest available gold prices as of October 2025. Future readers are encouraged to check updated spot prices from trusted sources to compare against long-term trends shared below.

Why This Post Matters

Most websites offer gold price history in India without citing sources or clarifying whether they use retail, spot, or average annual prices. This post is different:

- All historic prices are sourced from the RBI Handbook of Statistics on the Indian Economy

- Prices reflect average annual values based on financial years (April–March)

- Includes the latest market price (October 2025) for real-time context. Future readers can update this from reliable sources such as MCX.

Historical Gold Price Table (1983–2025)

| Financial Year | Avg Gold Price (₹ per 10g, 24K) |

|---|---|

| 1983–84 | ₹1,858 |

| 1984–85 | ₹1,984 |

| 1985–86 | ₹2,125 |

| 1986–87 | ₹2,323 |

| 1987–88 | ₹3,082 |

| 1988–89 | ₹3,175 |

| 1989–90 | ₹3,229 |

| 1990–91 | ₹3,452 |

| 1991–92 | ₹4,298 |

| 1992–93 | ₹4,104 |

| 1993–94 | ₹4,532 |

| 1994–95 | ₹4,667 |

| 1995–96 | ₹4,958 |

| 1996–97 | ₹5,071 |

| 1997–98 | ₹4,347 |

| 1998–99 | ₹4,268 |

| 1999–00 | ₹4,394 |

| 2000–01 | ₹4,474 |

| 2001–02 | ₹4,579 |

| 2002–03 | ₹5,332 |

| 2003–04 | ₹5,719 |

| 2004–05 | ₹6,145 |

| 2005–06 | ₹6,901 |

| 2006–07 | ₹9,240 |

| 2007–08 | ₹9,996 |

| 2008–09 | ₹12,890 |

| 2009–10 | ₹15,756 |

| 2010–11 | ₹19,227 |

| 2011–12 | ₹25,722 |

| 2012–13 | ₹30,164 |

| 2013–14 | ₹29,190 |

| 2014–15 | ₹27,415 |

| 2015–16 | ₹26,534 |

| 2016–17 | ₹29,665 |

| 2017–18 | ₹29,300 |

| 2018–19 | ₹31,193 |

| 2019–20 | ₹37,018 |

| 2020–21 | ₹48,723 |

| 2021–22 | ₹48,000 |

| 2022–23 | ₹52,731 |

| 2023–24 | ₹60,624 |

| 2024-25 | ₹75,842 |

Gold Spot Price (for Reference)

| Date | Spot Price (24K per 10g) |

| 15 July 2025 | ₹97,070 |

| 10 September 2025 | ₹1,09,173 |

| 21 October 2025 | ₹1,26,854 |

⚠️ Note: Spot prices are market rates as of the date and do not reflect annual averages used in RBI data. If you’re reading this after October 2025, please refer to updated prices from MCX or RBI sources to compare recent values.

Gold Price Chart (1983–2025)

Data Source: RBI Handbook of Statistics on the Indian Economy, 2024-25, Spot Rate (Jul, Sep, Oct 2025)

Decade-Wise CAGR Table

| Period | Start Price | End Price | CAGR (%) |

| 1983–1993 | ₹1,858.47 | ₹4,531.87 | 9.39% |

| 1993–2003 | ₹4,531.87 | ₹5,718.95 | 2.42% |

| 2003–2013 | ₹5,718.95 | ₹29,190.39 | 17.61% |

| 2013–2023 | ₹29,190.39 | ₹60,623.95 | 7.53% |

Long-Term CAGR (40 Years)

| Period | Start Price | End Price | CAGR (%) |

| 1983–2023 | ₹1,858.47 | ₹60,623.95 | 8.33% |

With Spot Price (September 2025)

| Period | Start Price | Spot Price | CAGR (%) |

|---|---|---|---|

| 1983 – 15 July 2025 | ₹1,858 | ₹97,070 | 8.57% |

| 1983 – 10 Sep 2025 | ₹1,858 | ₹1,09,173 | 8.89% |

| 1983 – 21 Oct 2025 | ₹1,858 | ₹1,26,854 | 9.27% |

Key Insights from 42 Years of Gold Price Data

- Gold has delivered a long-term CAGR of 8.3% to 9.3%

- The 2003–2013 decade saw explosive growth (17% CAGR)

- Post-2013, prices cooled but stayed steady

- In 2020, prices surged due to pandemic-era uncertainty

- As of October 2025, gold touched ₹1,26,854 per 10g – its highest ever

Future readers can update this spot value to compare against the long-term growth averages shared above

Why Did Gold Get So Expensive?

Over the last four decades, gold’s price in India has surged from ₹1,858 per 10g in 1983 to ₹1,26,854. Why?

Here are the key drivers:

- Inflation hedge: Gold has historically preserved value when currency purchasing power declined.

- Global economic uncertainty: Events like the 2008 financial crisis, COVID-19, and geopolitical tensions (e.g., Ukraine war) led to higher gold demand.

- Falling interest rates: As interest on savings dropped, investors turned to gold for safer returns.

- Rupee depreciation: Since India imports most of its gold, a weakening rupee made global prices even more expensive domestically.

- Cultural and retail demand: With weddings, festivals, and a deep-rooted belief in gold as wealth, India’s consistent demand added long-term price pressure.

Should You Consider Gold in 2025 and Beyond?

While gold may not offer explosive short-term returns, long-term data confirms its reliability as a store of value and inflation hedge.

| Use Case | Consider Gold? | Why It Matters |

| Wealth Preservation | ✅ Yes | Hedge against inflation & crisis |

| Portfolio Diversification | ✅ Yes | Adds balance alongside equities |

| Short-Term Gains | ⚠️ Be Cautious | Prices can stagnate for years |

| High-Growth Investment | ❌ No | Lacks compounding like stocks |

Think of gold not as a get-rich asset – but as your portfolio’s safety net.

Final Thoughts

Gold in India is more than an ornament – it’s a trusted store of value. With a proven record of returns and resilience, gold has outperformed inflation and preserved wealth for generations.

This blog aimed to offer you transparent, data-backed insights on gold price history in India along with its CAGR.

Whether you’re reading this in 2025 or beyond, let this serve as a reliable benchmark in your understanding of India’s evolving relationship with gold.

Data Sources :

- RBI Handbook of Statistics (1983–2024 averages)

- RBI Handbook of Statistics on the Indian Economy, 2024-25

- Spot price: MCX India (as of 15 July, 10 September, 21 October 2025)

Methodology :

- Year-wise gold price data was collected and cross-verified using RBI publications.

- CAGR = Compound Annual Growth Rate formula applied consistently

FAQs on Gold Price History & CAGR

What was the price of gold in India in 1983?

The average gold price in 1983-84 was ₹1,858 per 10g as per RBI data.

What is the CAGR of gold in India over the last 40 years?

Between 1983 and 2025, gold had a CAGR of ~9.3% based on RBI data + Oct 2025 spot price.

Is gold a good long-term investment in India?

Yes. Historically, gold has acted as a store of value with stable long-term returns, especially during inflation or economic crises.

Related Reads on Gold:

- Gold Made You Rich. Silver Made You Richer: RBI Data Reveals 40 Years of India’s Hidden Wealth Story (1983–2025)

- Why India Was Called the Golden Bird

- How Much Gold Does India Really Produce?

- Top Gold Reserve Holding Countries in 2025: Where Does India Stand

- India’s Gold Reserves (2000–2025): A Strategic Shift in National Wealth

About Indiagraphs Insights

Indiagraphs is a data storytelling platform focused on decoding India’s economy, policy, and people – one graph at a time.